Search Our Database

How to obtain Tax Identification Number (TIN)

Introduction

A Tax Identification Number (TIN) is a unique identifier issued by tax authorities to individuals and entities for tax purposes. It is essential for filing taxes, accessing government services, and conducting various financial transactions.

This guide outlines the steps, requirements, and key considerations for obtaining your TIN, whether you are an individual, a business owner, or part of an organization. By following these steps, you can ensure a smooth application process and compliance with tax regulations.

Prerequisites

- You must have the MyDigital ID app installed on your mobile phone.

- To set up MyDigital ID, refer to this guide: How to set up MyDigital ID on a mobile phone.

Once your MyDigital ID is set up and ready, follow the steps below to search for your Tax Identification Number:

1. Go to https://mytax.hasil.gov.my/ and click on the Search TIN tab.

2. A QR code will be displayed. Use the MyDigital ID app on your mobile phone to scan the code within 2 minutes.

3. Open MyDigital ID app on your mobile phone, and select Imbas QR (Scan QR).

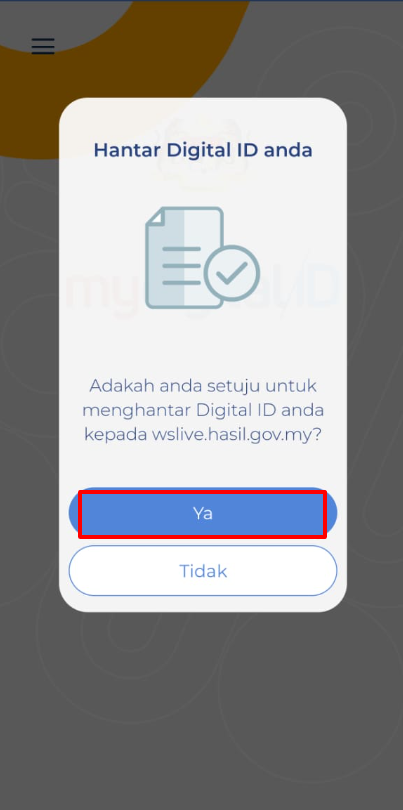

4. You will be prompted to approve sending your Digital ID to wslive.hasil.digital.gov. Click YES to proceed.

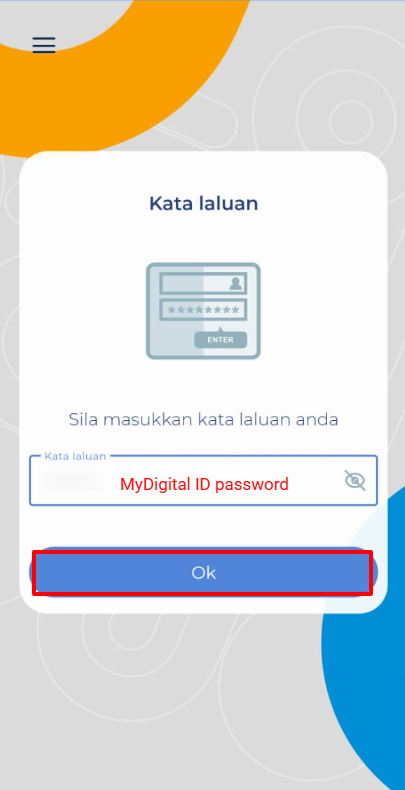

5. Input the password you previously set up for your MyDigital ID.

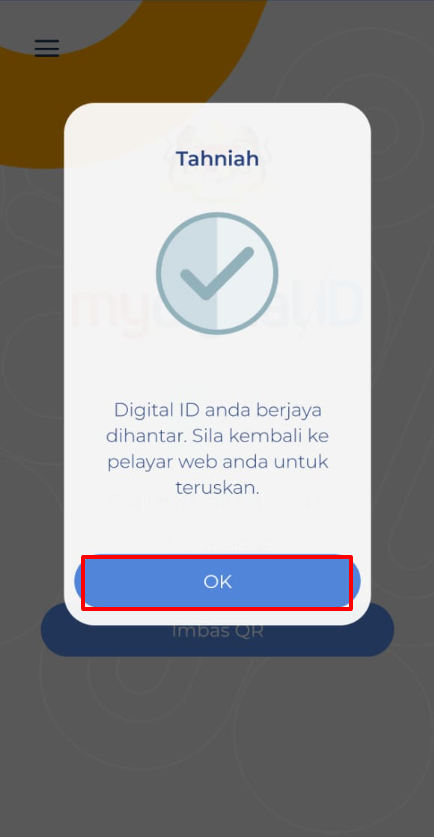

6. MyDigital ID has been successfully verified and connected to MyTax website. You may go back to https://mytax.hasil.gov.my/ to continue obtain the Tax information number.

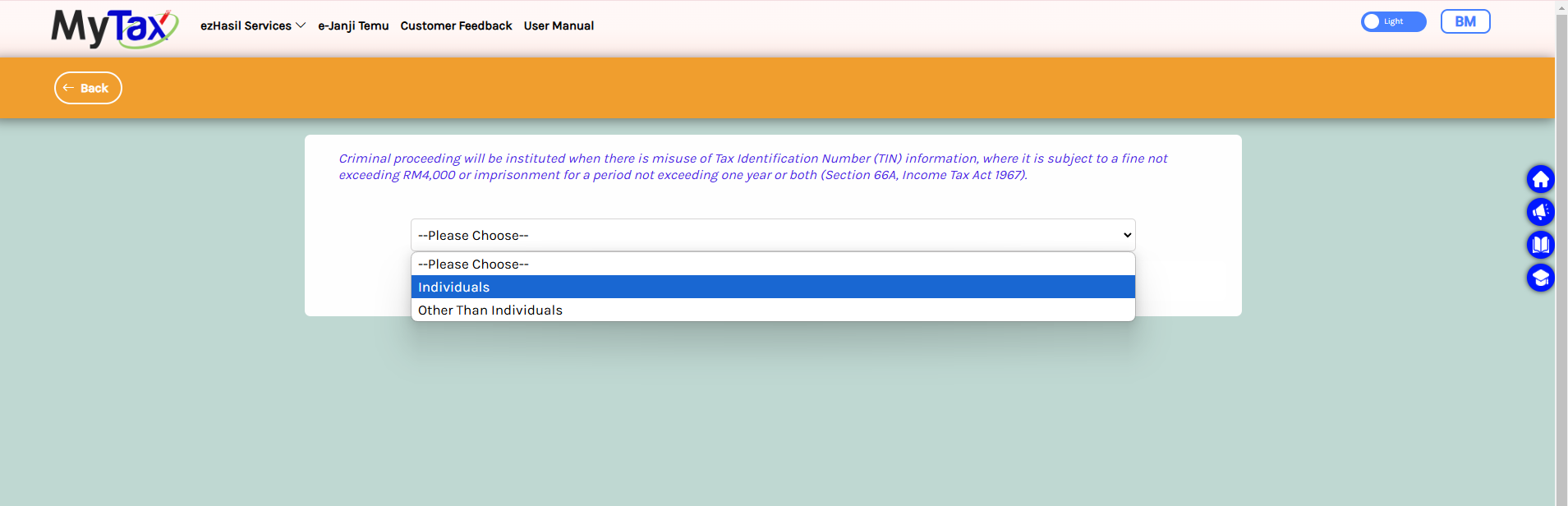

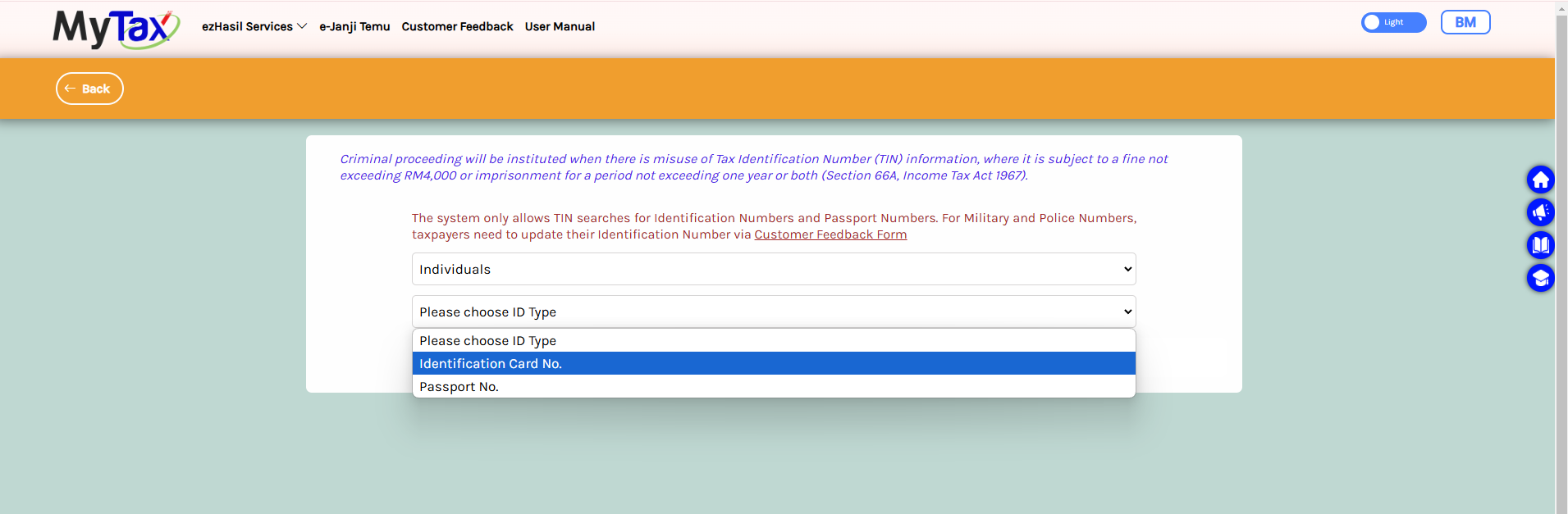

7. Choose the type of user you wish to search for, either it is Individuals or Other than Individuals (eg: company, Limited Liability Partnership (LLP), Corporation, etc)

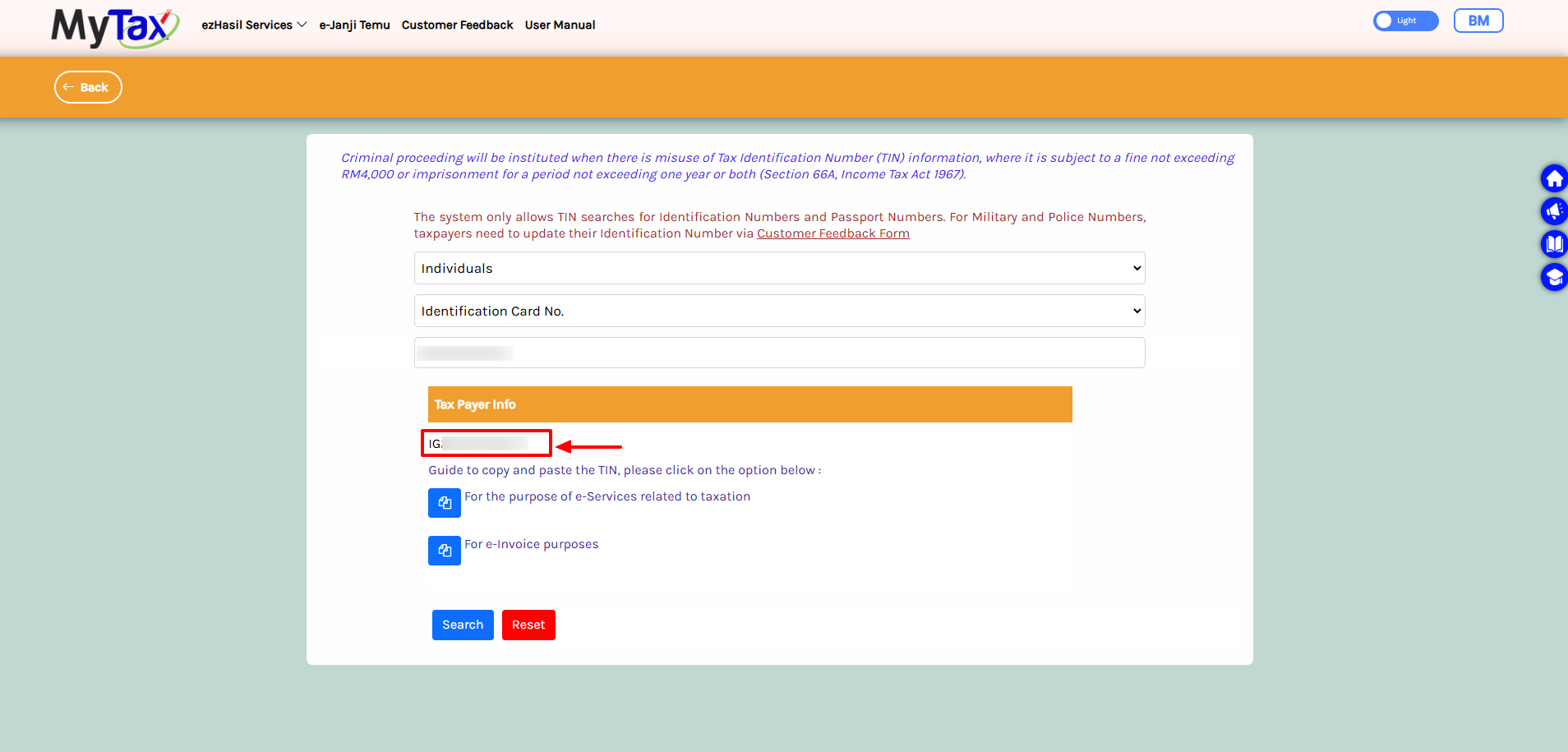

8. Search for Individual TIN: Enter your Identification Card (IC) number and click Search.

9. Your Tax Identification Number will be displayed. Save this number for future reference when making transactions that require your TIN.

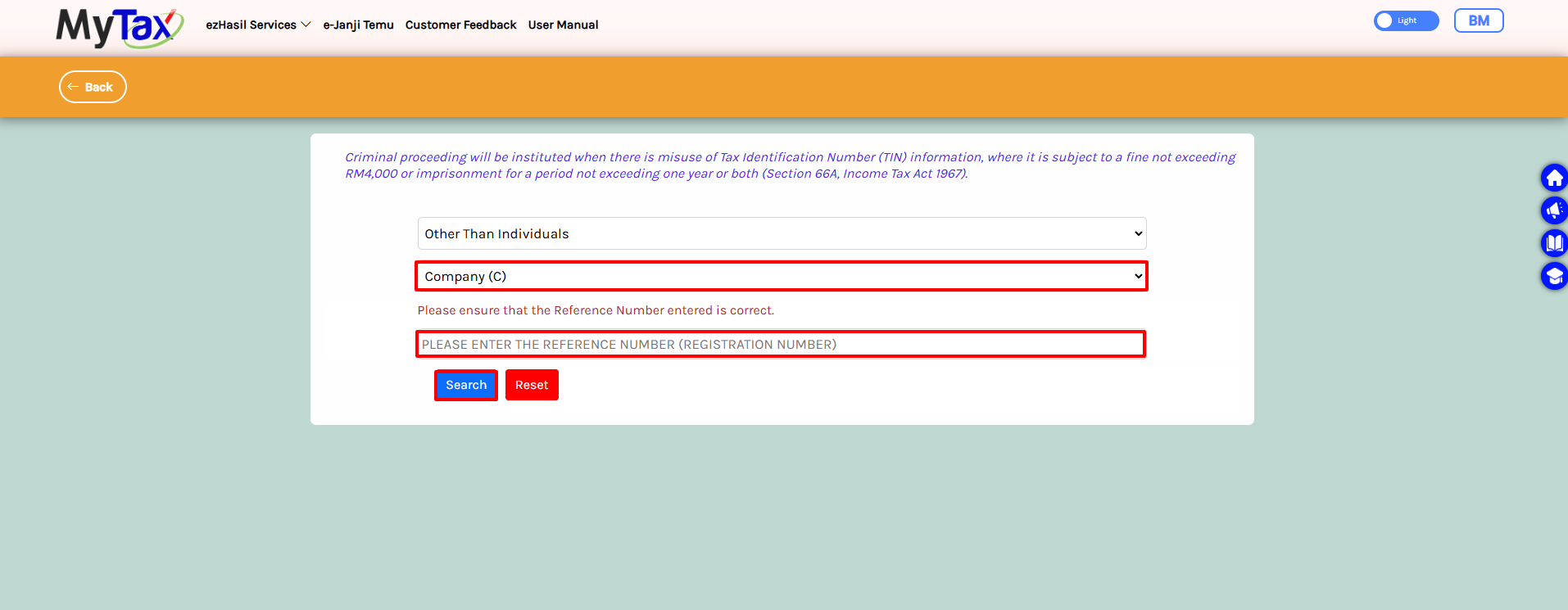

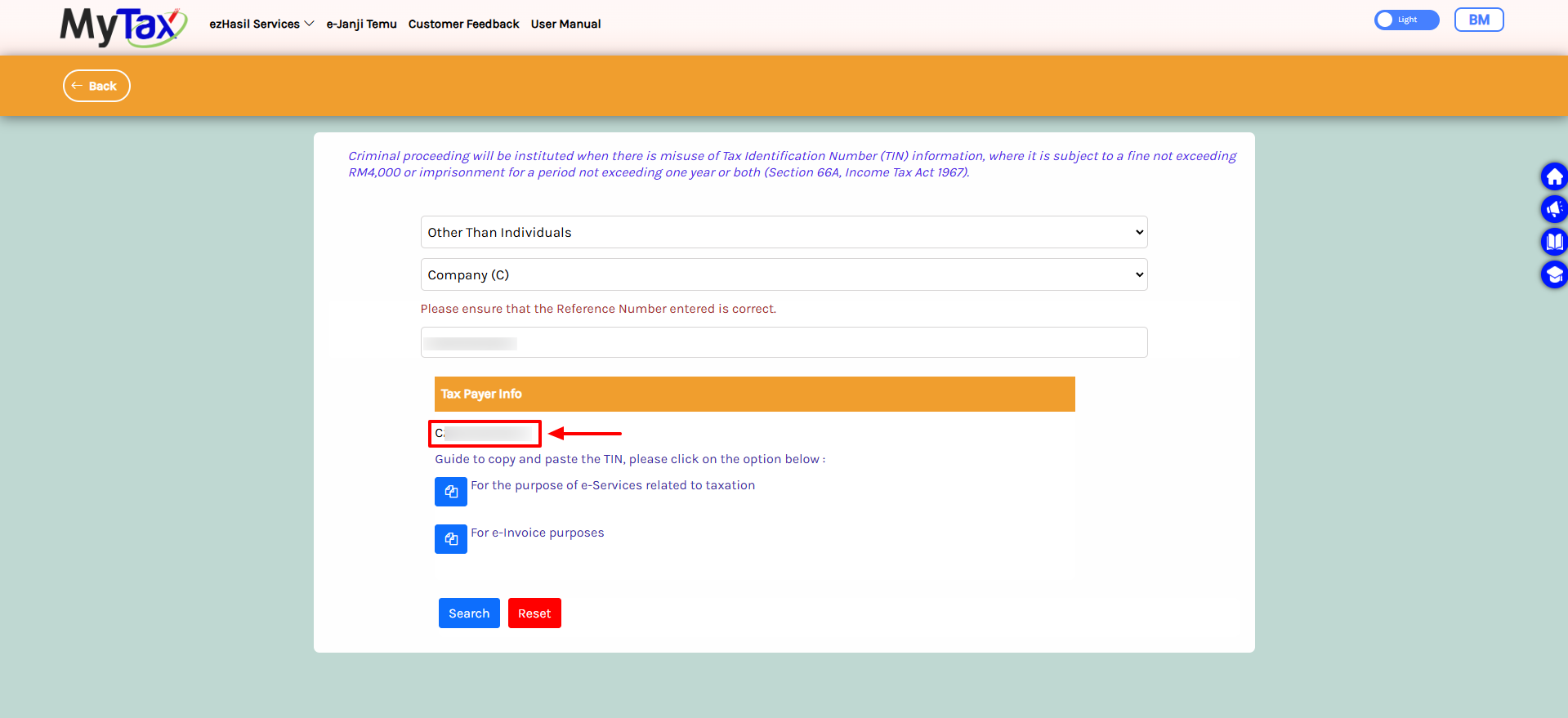

10. Search for Non-Individual TIN: For companies or organizations, select Other than Individuals and choose the appropriate category. Then, enter the company registration number.

11. You can copy the Tax Identification Number for tax-related e-Services or e-invoicing purposes.

Conclusion

By following this guide, you can efficiently retrieve your TIN and ensure compliance with tax regulations. Keep your TIN secure and readily accessible for any transactions or services that require it. For further assistance, visit MyTax or contact the relevant tax authority.